Mission

- An expert on the incorporation of international business companies of Vanuatu

- The leading incorporation provider of international business companies of Vanuatu in the regions of Hong Kong S.A.R., Macau S.A.R. and the People’s Republic of China (PRC)

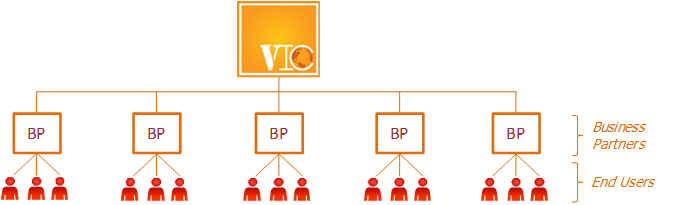

Business Model

- VIC focuses only on the incorporation and secretarial services on international business companies of Vanuatu

- VIC positions itself as distributor and wholesaler of Vanuatu international business companies

- VIC ’s strategy on B to B business model

VIC- Features and Merits

- May carry on business anywhere in the world except Vanuatu

- May carry on any business pursuant to Vanuatu International Companies Act Cap.222 except to the limitation of the jurisdiction the business is carried, e.g. banking, insurance

- Company name may end with Limited, Incorporated, Corporation, Sendirian Berhad, Responsabilite Limitee, Gesellschaft mit beschrankter Haftung, Besloten Vennootschap or their abbreviations

- Director and shareholder may be natural person or corporate entity, (1) no specific requirement on residence or citizenship, (2) minimum number is 1, (3) sole director may also be the sole shareholder

- Director meeting and shareholder meeting may be held anywhere

- Meetings via telephone, facsimile, conference calls, electronic means are acceptable

- May not require an authorized capital

- Government fee is fixed disregard the amount of capital

- Limited by shares or guarantee or both

- Bearer shares are allowed but shares can only be held by an authorized custodian not by the owner

- No audit on financial statements

- No annual returns, filing required

- Except the constitution filed with the Commission Registry, the company’s statutory registers will be maintained only with the registered agent

- No need to file with governmental authorities in respect of company structure

Company search not entertained unless authorized by the international company - High level of privacy and confidentiality

- Government support on high confidentiality by the provisions of the International Companies Act No.32 of 1992. The Act states that:

“125. (1) Any person, except when required by a court of competent jurisdiction, with respect to any company otherwise than for the purposes of the administration of this Act or for the carrying on of the business of the company, in Vanuatu or else-where, divulge, attempts, offers or threatens to divulges or induces or attempts to induce other persons to divulge any information cornering or respecting:

(a) the shareholding in or beneficial ownership of any share or shares in a company;

(b) the management of such company; or

(c) any of the business, financial or other affairs or transactions of the company ;

shall be guilty of an offence

(2) Any person who contravenes the provisions of sub section (1) shall, on conviction, be liable to a fine not exceeding US$ 100,000 or to imprisonment for a term not exceeding 5 years or to both such fine and imprisonment.” - At present, Vanuatu has not signed any international treaties on Tax Information Exchange Agreements (TIEA) with PRC, HK S.A.R. and Macau S.A.R.

– thus no formal channel on tax information exchange

– government has no intention to enter into such agreement to maintain the high level of tax privacy of the international companies - Vanuatu is currently on the “White list” of the OECD as Vanuatu has met substantially implemented internationally agreed-upon tax standards

- “White list” of the OECD means Vanuatu is not on the “Black list” of world money laundry nations

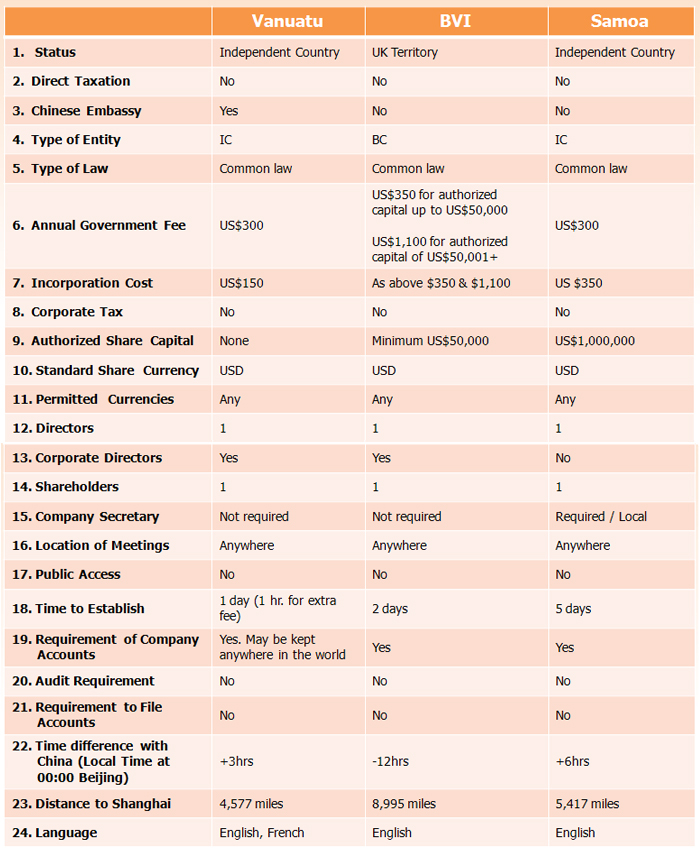

VIC vs. registered agent of other jurisdictions

- The official authorized representative of VFSC to maintain a database of all Chinese company names

- Two directors of VIC are duly appointed by VFSC as the Authorized Officers in the regions of the PRC to approve and certify any document for and on behalf of the VFSC, e.g. Certificate of Incorporation, Certificate of Good Standing, etc

- The two Authorized Officers of VIC are: Timothy Man Yau, Cheung and King Cheung, Ng

- VIC ’s business focuses only on the incorporation of international business companies of Vanuatu and no other business or jurisdiction

- Expert on international business companies of Vanuatu

- Leading incorporation provider of international business companies of Vanuatu

- Provide competitive rate than most of the other registered agent of other jurisdictions

VIC vs. other offshore companies

- Time zone of Vanuatu in Pacific region -> 3 hours ahead of Hong Kong which match substantially the business hours in Hong Kong, Macau and PRC (others mainly in Caribbean region, i.e. Caribbean is -12 hours and Samoa is -19)

- Most competitive rate

- Most quickest for incorporation and post-incorporation services, ranging from ½ to 1 business day, for instance:

– A tailor-made company may be set up within ½ business day on urgent basis

– Certificate of Good Standing, Certificate of Incorporation on tailor-made company may be issued within ½ business day - Chinese company name needs no Certificate of true translation by solicitor

- Chinese company name printed on Certificate of Incorporation and Constitution

- Vanuatu International Companies Act Cap.222 are in substantially the same provisions with other leading jurisdictions of offshore companies

- IC fully supported by the Trade Commission in Hong Kong

- Two Authorized Officers of VIC are duly appointed by VFSC to support a timely incorporation services in Hong Kong

- Vanuatu international business companies recently promoted to Asian countries, comparatively easy to reserve Chinese company name

- Well designed company kit with strong uniqueness

IC – Standard company Pack

- 1 International Company Record

- 1 original Constitution stamped by Commission Registry

- 3 copies of stamped Constitution

- 1 original Certificate of Incorporation

- 1 pocket with common seal and company chop

- 1 International Company Register (statutory registers)

- 10 Share Certificates

- 1 Incorporator Resolution appointing first director(s)

- 1 Quality Guarantee Certificate

- 1 set of Incorporation Minutes and Documents